When Gerry Gerntholz met his future wife, Marian, in college at North Dakota State University in Fargo, ND, she already loved Dakota Boys and Girls Ranch. “The Ranch touched Marian’s heart, even back then."…

donors

Through their recent and ongoing gifts to the Ranch, Leonard and Marie are committed to continuing the family legacy of giving by teaching their children and grandchildren about philanthropy. They want to show their family how giving not only benefits the charity but the donor.…

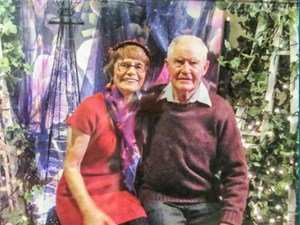

Herb and Jan Hegstad find joy in many places. They like to dance, play cards, and have friends over to visit. They enjoy wintering in Arizona where tennis, shuffleboard, Bocce ball, Bible study, and church services are all just a short walk away. And, they find joy in spending time with their children and grandchildren. But, their greatest joy is found in the Lord, and in caring for others.…

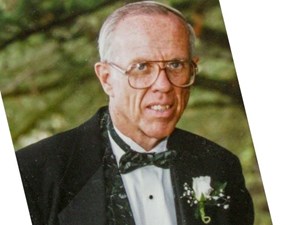

When Norman Luebkeman died in 2015, he left the majority of his estate, in excess of $2,000,000, to charity—with over $216,000 going to the Dakota Boys and Girls Ranch. Through his gift, Norman will live on through the many precious children who find hope and healing at the Ranch.…

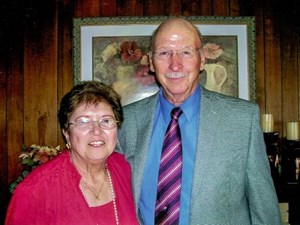

Ron and Shirley Hankel’s faith inspires them to financially support the Ranch—where they are helping to share Christ’s love and forgiveness with kids at the Ranch.…

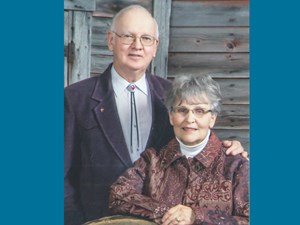

In 1974, Art and Grace first became acquainted with Dakota Boys and Girls Ranch. Their interest in the state, and in children, led to their ongoing support of the Ranch. They made their first cash gift in 1974, and continued their support throughout the rest of Art’s life. Grace continues to support the Ranch today.…

“The fact that the Ranch weds spiritual life and healing is what gets me to North Dakota in December when it’s 18 below,” says Rev. William Simmons (Pastor Bill). Pastor Bill, a member of the Dakota Boys and Girls Ranch Foundation board of directors, comes to Ranch board meetings from St. Louis, MO—where he enjoys a much warmer climate, is recently retired from his position as the administrative pastor at Christ Memorial Lutheran Church, and enjoys family time with his wife, Gail, their four children, and four grandchildren.…